Sage Accounting Software Tutorial|2025

Sage Accounting Software is a powerful and user-friendly solution designed to simplify financial management for small businesses, medium enterprises, and even larger organizations. With features like invoicing, expense tracking, tax calculation, and payroll integration, Sage Accounting Software empowers businesses to maintain accurate records and make informed financial decisions.

This tutorial provides a comprehensive guide to understanding and using Sage Accounting Software effectively. Whether you’re a business owner, accountant, or student, this article will help you unlock the full potential of Sage Accounting.

What is Sage Accounting Software?

Sage Accounting Software is a cloud-based financial management tool developed by Sage Group. It offers a range of solutions tailored to the needs of businesses across various industries. Known for its intuitive interface and robust functionality, Sage is a preferred choice for managing accounting tasks, ensuring compliance, and gaining real-time insights into financial performance.

Key Features of Sage Accounting Software

- Invoicing: Create and send professional invoices to clients.

- Expense Tracking: Monitor and categorize business expenses efficiently.

- Bank Reconciliation: Match transactions automatically with your bank records.

- Tax Compliance: Simplify VAT, GST, and other tax calculations.

- Payroll Integration: Manage employee salaries, taxes, and benefits.

- Reporting: Generate financial reports such as profit and loss, balance sheets, and cash flow statements.

- Multi-Currency Support: Ideal for businesses operating globally.

- Cloud Access: Access your accounts anytime, anywhere.

Why Use Sage Accounting Software?

1. Ease of Use

Sage is designed to be user-friendly, even for those with minimal accounting knowledge.

2. Scalability

Whether you’re running a small startup or a growing enterprise, Sage offers solutions that scale with your business.

3. Cost-Effectiveness

Sage Accounting Software provides affordable pricing plans tailored to different business needs.

4. Compliance and Security

With features designed to comply with tax regulations and protect data, Sage ensures peace of mind for users.

5. Integration

Easily integrates with other tools and platforms like CRM systems, payment gateways, and third-party apps.

Getting Started with Sage Accounting Software

Step 1: Choosing the Right Sage Solution

Sage offers various products to cater to different needs. Common options include:

- Sage Business Cloud Accounting: Ideal for small businesses.

- Sage Intacct: Designed for medium-sized enterprises.

- Sage 50cloud Accounting: Combines desktop functionality with cloud accessibility.

Step 2: Signing Up and Setting Up Your Account

- Visit the official Sage website and select the product that suits your needs.

- Sign up by providing your business details.

- Customize your account settings, including currency, tax rates, and financial year.

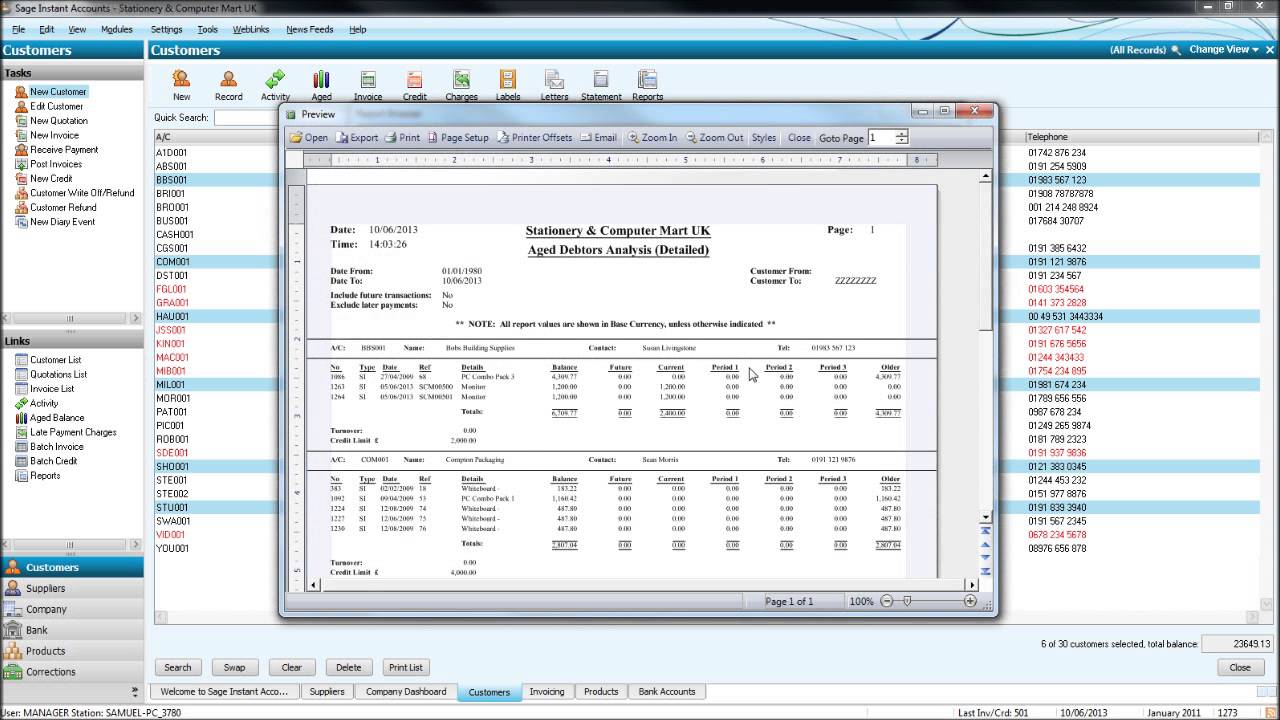

Step 3: Navigating the Dashboard

The dashboard provides an overview of your business’s financial health, including:

- Recent transactions

- Invoices due

- Cash flow insights

- Quick links to key functions

Step 4: Setting Up Chart of Accounts

Organize your financial data by setting up a chart of accounts that categorizes assets, liabilities, equity, income, and expenses.

How to Use Sage Accounting Software

1. Managing Invoices

- Navigate to the “Sales” section and click “Create Invoice.”

- Fill in customer details, items or services provided, and payment terms.

- Send invoices directly via email or download them as PDFs.

2. Tracking Expenses

- Go to the “Expenses” tab and select “Add Expense.”

- Input details such as expense type, amount, and payment method.

- Attach receipts or supporting documents for recordkeeping.

3. Reconciling Bank Transactions

- Connect your bank account to Sage.

- Match transactions automatically using Sage’s reconciliation feature.

- Resolve discrepancies by reviewing flagged items.

4. Generating Financial Reports

- Access the “Reports” section to generate detailed reports.

- Common reports include:

- Profit and Loss Statement

- Balance Sheet

- Cash Flow Report

- Customize report filters for specific time frames or categories.

5. Managing Payroll

- Add employee details and set up payroll schedules.

- Automate salary calculations, including taxes and benefits.

- Generate payslips and maintain compliance with labor laws.

6. Tracking Taxes

- Set up tax rates applicable to your business location.

- Automatically calculate VAT, GST, or sales tax for transactions.

- File tax returns directly from the software (available in some regions).

Tips for Using Sage Accounting Software Effectively

1. Regular Updates

Keep your software updated to access new features and maintain security.

2. Leverage Automation

Utilize automated reminders, recurring invoices, and scheduled payments to save time.

3. Customize Settings

Tailor the software’s settings to match your business’s specific needs.

4. Use Shortcuts

Learn keyboard shortcuts and favorite frequently used features for faster navigation.

5. Back Up Data

Even with cloud storage, regular backups ensure data safety in case of unexpected issues.

Common Challenges and Solutions

Challenge 1: Understanding Features

Solution: Utilize Sage’s online tutorials, user guides, and customer support.

Challenge 2: Integrating with Other Tools

Solution: Check compatibility with third-party applications or use Sage’s API for custom integrations.

Challenge 3: Adapting to Changes

Solution: Regularly train your team on updates and new functionalities.

Benefits of Sage Accounting Software

1. Time-Saving

Automated processes reduce manual workload.

2. Enhanced Accuracy

Minimizes human error in financial data management.

3. Improved Cash Flow Management

Real-time insights help monitor cash flow effectively.

4. Compliance

Built-in tax tools simplify regulatory compliance.

5. Mobility

Cloud-based access allows work from anywhere.

Industries That Benefit from Sage Accounting Software

- Retail: Streamlines sales tracking and inventory management.

- Construction: Tracks project costs and manages contractor payments.

- Nonprofits: Simplifies fund tracking and compliance reporting.

- Healthcare: Ensures accurate billing and payroll management.

- Hospitality: Manages bookings, expenses, and revenue efficiently.

Future of Sage Accounting Software

Sage continues to evolve by integrating artificial intelligence (AI), machine learning (ML), and advanced analytics. Future updates are expected to:

- Enhance automation capabilities.

- Improve integration with emerging technologies.

- Provide more robust mobile applications.

Conclusion

Sage Accounting Software is an indispensable tool for businesses looking to streamline their financial operations. Its robust features, user-friendly interface, and scalability make it suitable for a wide range of industries. By understanding how to navigate and leverage Sage’s capabilities, businesses can achieve greater efficiency, accuracy, and compliance.

Start your journey with Sage Accounting Software today and transform the way you manage your finances. With continuous updates and support, Sage ensures you stay ahead in the competitive business landscape.

Needs help with similar assignment?

We are available 24x7 to deliver the best services and assignment ready within 3-4 hours? Order a custom-written, plagiarism-free paper