Understanding the PMT Function in Excel: A Comprehensive Guide|2025

/in Advanced Excel Articles /by BesttutorUnderstanding the PMT function in Excel: Learn how to calculate loan payments, understand its syntax, and apply it effectively for financial planning and analysis.

The PMT function in Excel is one of the most powerful and widely used functions when dealing with finance and loan-related calculations. It allows users to calculate the payment amount for a loan or an investment based on constant payments and a constant interest rate. Whether you’re managing a mortgage, personal loan, or business financing, understanding the PMT function can save you significant time and effort. This paper will explore the PMT function in detail, covering its meaning, how to use it, and provide examples. We will also delve into how to calculate PMT manually and understand the underlying formula.

Table of Contents

ToggleWhat is the PMT Function in Excel?

The PMT function in Excel is a built-in function that calculates the periodic payment for a loan based on constant interest rates and a fixed payment schedule. In simpler terms, it helps determine how much you need to pay regularly (e.g., monthly or annually) to repay a loan over a specified period at a particular interest rate.

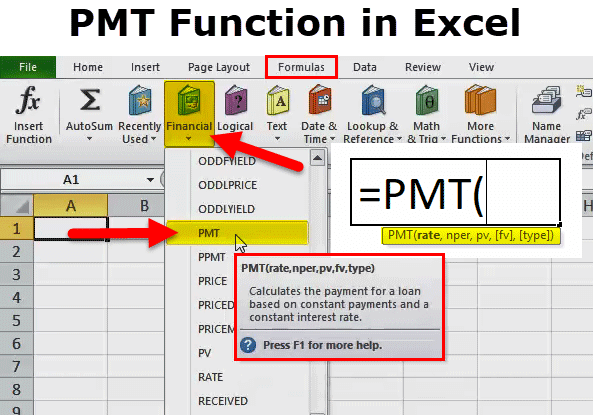

The syntax for the PMT function is as follows:

PMT(rate, nper, pv, [fv], [type])

Parameters:

- Rate: This is the interest rate for each period.

- Nper: The number of payment periods in the loan or investment.

- PV (Present Value): The present value, or the principal amount of the loan or investment.

- FV (Future Value): This is an optional argument and represents the future value or the cash balance you want after the last payment. If omitted, the default value is zero.

- Type: This is another optional argument that specifies when the payment is due. Use 0 if payments are made at the end of each period (default), or 1 if payments are made at the beginning.

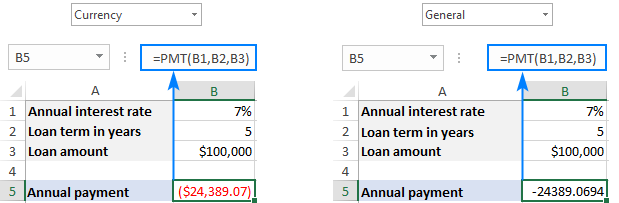

Example of PMT Function

Suppose you want to take out a loan of $100,000 for a term of 5 years at an annual interest rate of 6%. To calculate the monthly payment, you would use the following formula:

=PMT(6%/12, 5*12, 100000)

In this case:

- Rate: 6% annual interest, divided by 12 for monthly payments.

- Nper: 5 years, with 12 payments per year, so 5*12.

- PV: The principal amount of $100,000.

Result:

This formula will return the monthly payment amount that needs to be paid to repay the loan.

PMT Formula with Example

To dive deeper into how the PMT formula works, let’s explore a detailed example. Let’s assume you need to calculate the monthly payment for a $150,000 loan with an interest rate of 7% per year, to be repaid over 30 years.

Step 1: Break Down the Values

- Rate: 7% annually, so the monthly interest rate is 7%/12 = 0.5833%.

- Nper: The loan term is 30 years, and since the payments are monthly, the total number of periods is 30*12 = 360.

- PV: The loan amount is $150,000.

Step 2: Apply the PMT Formula

=PMT(7%/12, 30*12, 150000)

Result:

The monthly payment for this loan would be approximately $998.77.

This example illustrates how the PMT formula can be used to calculate fixed payments over a loan period, which is helpful for budgeting and understanding the financial obligations associated with loans.

How to Calculate PMT Manually

While Excel makes it easy to calculate the PMT, you might want to understand how the formula works manually for a deeper comprehension. The general formula for calculating PMT manually is derived from the annuity formula, which is used to calculate the constant payments of a loan or investment:

PMT = \frac{PV \times \frac{r(1 + r)^n}{(1 + r)^n – 1}}Where:

- PV = Present Value (Principal)

- r = Interest rate per period

- n = Number of payment periods

Example Calculation

Let’s take the same loan example as before:

- Loan amount (PV): $150,000

- Annual interest rate: 7%

- Loan term: 30 years

Step-by-step, we can break down the formula as follows:

- Convert the annual interest rate to a monthly interest rate: 7% / 12 = 0.5833% or 0.005833.

- The number of periods (n) is 30 years * 12 months = 360.

- Plug these values into the formula:

PMT = \frac{150000 \times \frac{0.005833(1 + 0.005833)^{360}}{(1 + 0.005833)^{360} – 1}}After performing the calculation, we will arrive at the same monthly payment of $998.77.

Why is this important?

Understanding how to calculate PMT manually is essential for verifying the results from the Excel function, and it also gives you insight into the financial formula behind the function.

How to Calculate PMT Without Excel

Although Excel is a convenient tool for calculating PMT, it’s important to know how to calculate PMT without it. There are several ways to perform this calculation manually:

- Using the Manual Formula: As shown above, you can use the annuity formula to calculate PMT.

- Using a Financial Calculator: Many financial calculators come with built-in functions to compute PMT. These calculators are designed to handle the complexities of financial calculations, such as loan payments, interest rates, and investment returns.

- Using Online PMT Calculators: Numerous online tools and websites allow users to input the loan amount, interest rate, and loan term, and they will return the PMT for you. These calculators are helpful for quick estimations.

PMT Formula Meaning

The PMT formula is a financial equation used to calculate the regular payment that needs to be made on a loan or investment. The payment includes both principal and interest components, which vary over time. In the early stages of a loan, a larger portion of the payment goes towards paying off interest, while later payments are more focused on reducing the principal balance.

The formula essentially determines the amount that must be paid on a consistent basis to fully repay the loan by the end of the term. This calculation takes into account the interest rate, the principal amount, and the loan term to ensure that the borrower can meet their financial obligations.

What is PMT in Finance?

In finance, PMT stands for “payment,” and it refers to the regular payment amount made to settle a debt or investment. This payment includes both the principal amount (the original loan value) and the interest accrued over the term of the loan or investment. The PMT function is crucial for individuals, businesses, and financial institutions as it allows them to understand their financial commitments in terms of recurring payments.

PMT is used in a variety of financial applications, including:

- Loan amortization: Helping borrowers understand how much they need to pay on a loan.

- Investment planning: Allowing investors to calculate regular investment payments.

- Budgeting: Assisting both individuals and businesses in managing their finances and predicting future payments.

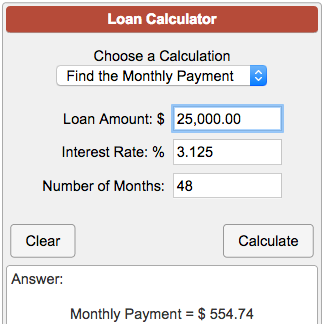

PMT Calculator

A PMT calculator is an online tool or software that helps calculate the regular payment (PMT) required to settle a loan or investment based on input parameters like loan amount, interest rate, and term length. These calculators are invaluable for individuals who want to quickly determine their financial obligations without having to manually apply the PMT formula.

Many PMT calculators also provide additional features, such as the ability to visualize payment schedules and generate amortization tables. This helps users better understand how their payments are distributed between principal and interest over the loan term.

Conclusion

The PMT function in Excel is a powerful and essential tool for anyone involved in financial planning or dealing with loans and investments. By understanding how the PMT formula works and applying it in Excel, you can easily calculate the regular payments required to manage debts or investments. Moreover, knowing how to calculate PMT manually or using a PMT calculator provides added flexibility for handling financial calculations in different scenarios.

Whether you are calculating monthly mortgage payments, planning for an investment, or managing a business loan, the PMT function in Excel can save you valuable time and effort while ensuring that you remain on top of your financial commitments.

Needs help with similar assignment?

We are available 24x7 to deliver the best services and assignment ready within 3-4 hours? Order a custom-written, plagiarism-free paper