How to Generate Financial Reports Using SAGE|2025

Learn how to generate financial reports using SAGE, from balance sheets to profit and loss statements, and streamline your financial analysis with step-by-step guidance.

Financial reporting is essential for businesses to assess their financial health, comply with regulatory requirements, and make informed decisions. SAGE, a leading accounting software, provides robust financial reporting capabilities that streamline the process of generating accurate and timely reports. This paper explores the process of generating financial reports using SAGE, covering setup, report types, customization, and best practices.

1. Understanding Financial Reports in SAGE

SAGE accounting software offers a variety of financial reports, including:

- Profit and Loss Statement (Income Statement) – Shows revenues, expenses, and net profit/loss over a specific period.

- Balance Sheet – Summarizes a company’s assets, liabilities, and equity at a given point in time.

- Cash Flow Statement – Tracks the inflow and outflow of cash within a business.

- Trial Balance – Provides a summary of all ledger balances to ensure debits and credits are equal.

- Accounts Receivable and Payable Reports – Display outstanding invoices and payments due.

- Budget vs. Actual Reports – Compare actual financial performance against planned budgets.

2. Setting Up SAGE for Financial Reporting

Installing and Configuring SAGE

To generate accurate financial reports, ensure SAGE is correctly installed and configured:

- Choose the right version of SAGE for your business (SAGE 50, SAGE 200, or SAGE Intacct).

- Set up the company profile, including name, currency, tax settings, and reporting preferences.

- Define the financial year and accounting periods.

Setting Up Chart of Accounts

The Chart of Accounts categorizes financial transactions:

- Define revenue, expense, asset, liability, and equity accounts.

- Ensure accounts are properly mapped to generate accurate reports.

- Use SAGE’s default Chart of Accounts or customize it based on business needs.

3. Generating Financial Reports in SAGE

Accessing the Reporting Module

- Log into SAGE and navigate to the Reports or Financials section.

- Choose the type of financial report needed.

Generating Standard Reports

For common financial statements:

- Select Profit and Loss Statement or Balance Sheet from the menu.

- Specify the reporting period (monthly, quarterly, yearly, or custom dates).

- Select additional filters if required, such as department, project, or location.

- Click Generate Report to view and analyze financial data.

Customizing Reports

SAGE allows users to tailor reports to meet specific business needs:

- Modify report columns – Add or remove financial metrics.

- Apply filters – Focus on specific cost centers, projects, or locations.

- Adjust report layouts – Choose summary or detailed views.

- Change formatting – Modify fonts, colors, and number formatting for better readability.

Exporting and Printing Reports

- Export reports in multiple formats, including PDF, Excel, and CSV.

- Print reports for internal meetings, audits, or financial analysis.

- Schedule automated report generation and delivery to stakeholders.

4. Advanced Financial Reporting Features in SAGE

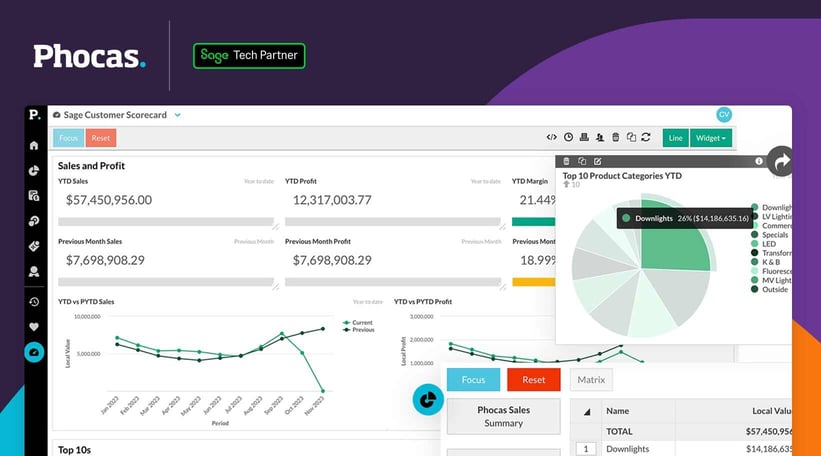

Using Financial Dashboards

SAGE provides visual dashboards to track financial performance in real-time:

- Display key financial indicators such as revenue, expenses, and profit margins.

- Use interactive charts and graphs for better data interpretation.

- Customize dashboards for management reporting.

Consolidated Financial Reporting

For businesses with multiple branches or subsidiaries:

- Generate consolidated financial statements across different entities.

- Use multi-currency support for global operations.

- Automate inter-company transactions and eliminations.

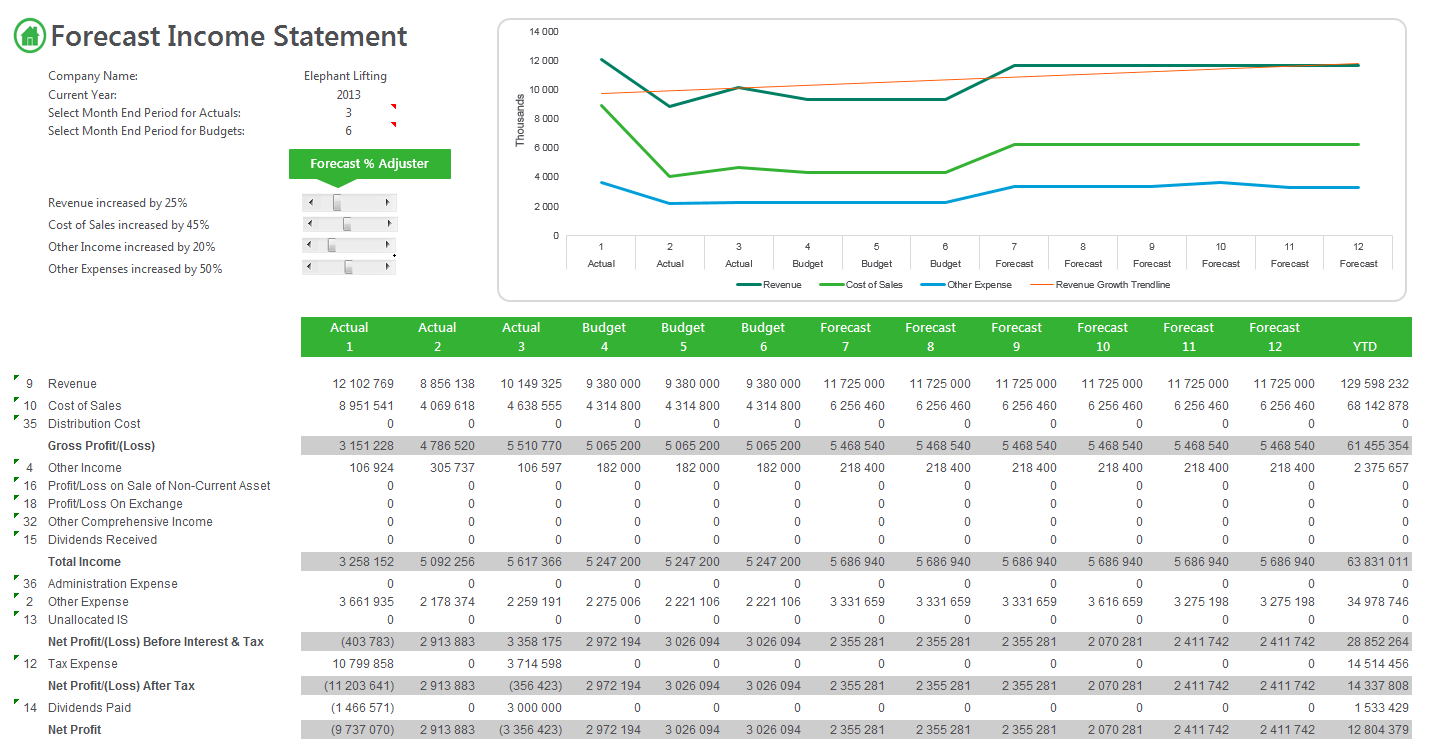

Forecasting and Budgeting Reports

- Create budget reports to compare planned vs. actual performance.

- Use historical data for financial forecasting.

- Adjust budgets based on real-time financial data.

Audit Trails and Compliance Reporting

- Generate audit trails for tracking financial transactions.

- Ensure compliance with IFRS, GAAP, or tax regulations.

- Use predefined templates for tax filings and regulatory reporting.

5. Best Practices for Effective Financial Reporting in SAGE

Maintain Accurate Financial Data

- Regularly update and reconcile accounts to ensure data integrity.

- Automate bank reconciliations and expense tracking.

- Review financial transactions for errors and discrepancies.

Utilize SAGE Integrations

- Integrate SAGE with payroll, CRM, and inventory management systems.

- Sync data with cloud storage for easy access and collaboration.

- Use APIs to connect SAGE with third-party financial tools.

Train Employees on SAGE Reporting

- Provide training for finance teams on how to generate and analyze reports.

- Leverage SAGE’s online resources, tutorials, and support community.

Schedule Regular Financial Reviews

- Conduct monthly or quarterly financial reviews with management.

- Use financial reports for strategic planning and decision-making.

Conclusion

SAGE simplifies financial reporting by providing automated, customizable, and insightful reports for businesses of all sizes. By leveraging SAGE’s financial reporting capabilities, businesses can enhance financial transparency, streamline compliance, and make data-driven decisions. Understanding how to generate and customize financial reports in SAGE ensures that businesses can maintain financial accuracy and strategic planning efficiency.

Needs help with similar assignment?

We are available 24x7 to deliver the best services and assignment ready within 3-4 hours? Order a custom-written, plagiarism-free paper